‘I would have paid’: Ottawa residents claim they were unaware of outstanding tickets now dropping their credit scores

Since reporting on old fines tanking the credit scores of thousands of Ottawans and former residents, CTV News has received a flood of similar accounts from people claiming the city and its contracted collection agencies did not do enough to contact them before their credit score was slashed.

Jennifer Riley is one such individual who is now dealing with a reduced credit score. That’s because she has an outstanding speeding ticket from 2005 that she thought she had paid 19 years ago.

Riley is now looking to purchase a home in the city, but her weakened credit score is a major concern.

“Sunday night I didn’t sleep. I was so stressed because obviously buying a home is stressful enough, but having your credit score reduced dramatically is another stress,” she said.

Riley says she first learned about the unpaid ticket when she realized her credit score was reduced by more than 30 points.

Some who have contacted CTV News with similar stories have seen their score plummet by more than 150 points.

Most people, including Riley, have since paid the outstanding fine but the collection history will remain on their credit report for at least seven years.

Joseph Muhuni is deputy treasurer for the City of Ottawa overseeing revenue. He tells CTV News that after being issued a ticket or fine, people are sent four to five notices in a span of three to four months.

If the fine is still unpaid, the city brings in a collection agency that is paid an unspecified commission to gather up any outstanding debts. There are two tiers of collection agencies.

He says the city has been using collection agencies for 20 to 25 years.

“Every five years we go through a competitive process. If there are new collection agencies that win the bid, they will come on board and then they will be get transitioned a collection load from the previous collection agency to the new one,” said Muhuni.

“In the last cycle, we happened to get a second-tier collection agency called Financial Debt Recovery (FDR) which only collects on debts that have been through other collection agencies.”

Muhuni adds that if people are seeing a credit alert because of a debt collection notice, “Collection agencies generally have their own methods and approaches in terms of making sure that notices are being sent to the correct addresses.

“If it’s older debt, they have ways and approaches that they can use to get the most current information, and then make sure that they’re contacting the residents to get payment for the debt.”

When asked whether she has received any form of communication since the ticket was issued, Riley says, there was none.

“I wish I had because I would have paid $140 for it back then,” she said. “I feel like they didn’t do their due diligence. If they were able to find me without having my driver’s license and to find my self insurance number, they should have been able to find me.”

Riley is not alone.

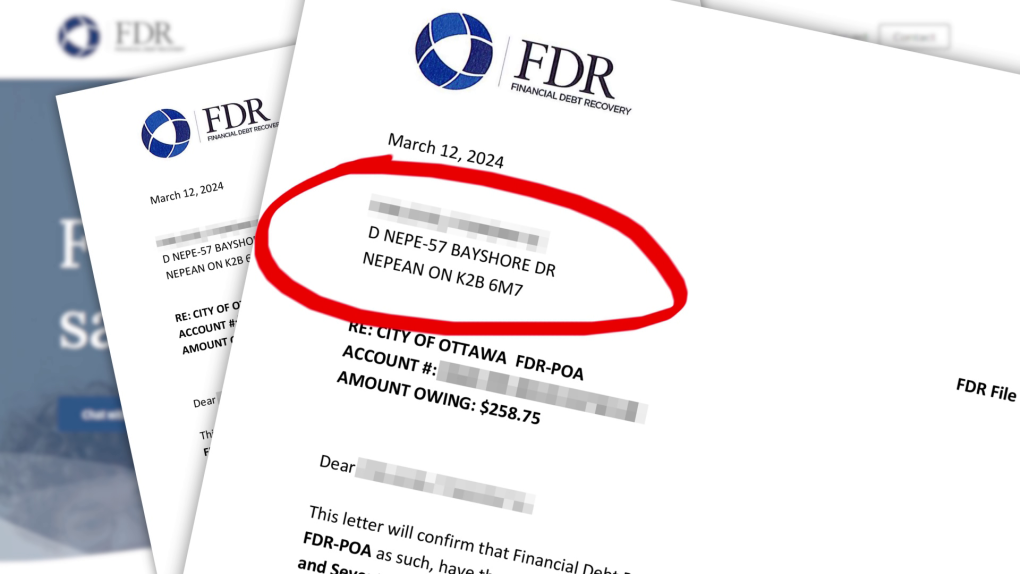

One woman who asked not to be identified sent CTV News a copy of the letter that was supposedly mailed to her by FDR to inform her of her outstanding fine. She obtained the copy by contacting the collection agency directly, and asking for the letter.

One woman who asked not to be identified sent CTV News a copy of the letter that was supposedly mailed to her by FDR to inform her of her outstanding fine. She says, not only has she not lived in Ottawa for nearly a decade, she was not living on Bayshore Drive at the time she was allegedly issued a ticket.

One woman who asked not to be identified sent CTV News a copy of the letter that was supposedly mailed to her by FDR to inform her of her outstanding fine. She says, not only has she not lived in Ottawa for nearly a decade, she was not living on Bayshore Drive at the time she was allegedly issued a ticket.

The address listed on that letter is “D NEPE-57 Bayshore Dr. Nepean ON. K2B 6M7”.

She says, not only has she not lived in Ottawa for nearly a decade, she was not living on Bayshore Drive at the time she was allegedly issued a ticket.

To cap off the issues, the address FDR had on file for her is not even compliant with Canada Post.

Her credit score was slashed by 116 points and she’s just one of a growing list of Ottawans are seeing their credit scores cut back.

“It’s taken years just to go up 80 points by paying my bills on time and reducing debt. It takes a lot,” said Riley.

“It takes one little blemish to bounce it right back down again.”

FDR did not respond to a request for comment.

View original article here Source