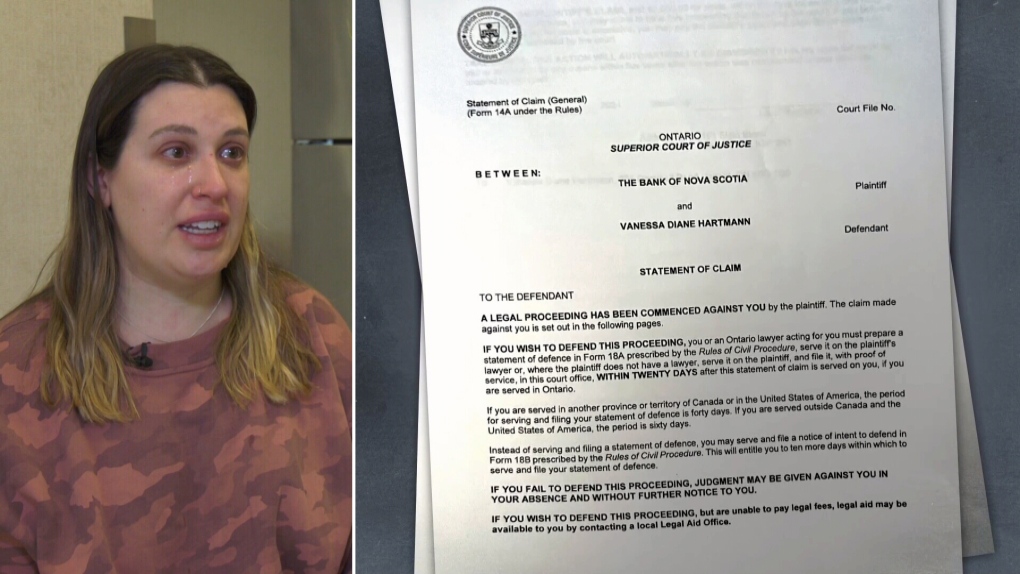

Ottawa woman faces foreclosure and bankruptcy after Scotiabank serves her papers

An Ottawa woman has had her life turned upside down and is now facing bankruptcy in a perfect storm of unfortunate events.

“I just feel like I’m tracking through the mud and swimming against the current. It just feels like a never ending nightmare,” said Vanessa Hartmann.

It all started two years ago, when she purchased a home in Jasper, Ont. along the Rideau River.

At the time, the property was listed for $465,000, but Hartmann says she paid $200,000 over the asking price.

“It was quite ludicrous, there were bidding wars and it was just really stressful,” said Hartmann.

But just seven months later, she was laid off from her well-paying job at Microsoft and at the same time, soaring interest rates nearly doubled her mortgage.

“I said ok, I can’t afford this but then I started to default on my payments,” said Hartmann.

Hartmann said she tried to sell her house through two different realtors and ended up handing the keys over to Scotiabank in November.

“I moved out of the property and to my knowledge the bank was changing the locks,” said Hartmann.

A few months later, the bank served her with foreclosure papers. She said she was unable to afford a lawyer and did not qualify for legal aid. As a result, she’s now awaiting a default judgement and faces the possibility of bankruptcy.

“You literally go from owning a property and having a job with a great income, to being faced with homelessness in less than a year,” said Hartmann.

Scotiabank told CTV News that it could not comment on individual customer matters for privacy reasons.

Marc Rouleau, vice-president and insolvency trustee at Doyle Salewski Inc., tells CTV News that stories like Hartmann’s are becoming more common with rising interest rates and historically high levels of household debt.

“There’s a lot of adjustment that’s going to happen. This is not a next week, next month, next year, it’s going to be for a long time that people need to adjust to the new reality,” said Rouleau.

While default rates remain low, the Canadian Mortgage and Housing Corporation (CMHC) says warning signs are on the horizon.

“We are seeing some of those earlier stage delinquencies, so more than 30 days less than 60 days or more than 60 days, less than 90 days. Those numbers are starting to increase,” said Seamus Benwell, a specialist of housing research with CMHC.

As for Vanessa, she’s hoping her cautionary tale serves as a warning to others.

“I want people to know that this is a possibility for anybody, you know, an educated hardworking woman like myself is now faced with homelessness,” said Hartmann.

View original article here Source