Toronto home prices up 42 per cent over last five years, cost of living up 17 per cent: report

The cost of living in Toronto went up nearly 20 per cent between 2017 and 2022 – but that’s less than half the increase seen in the city’s housing prices over the last five years, according to a new report.

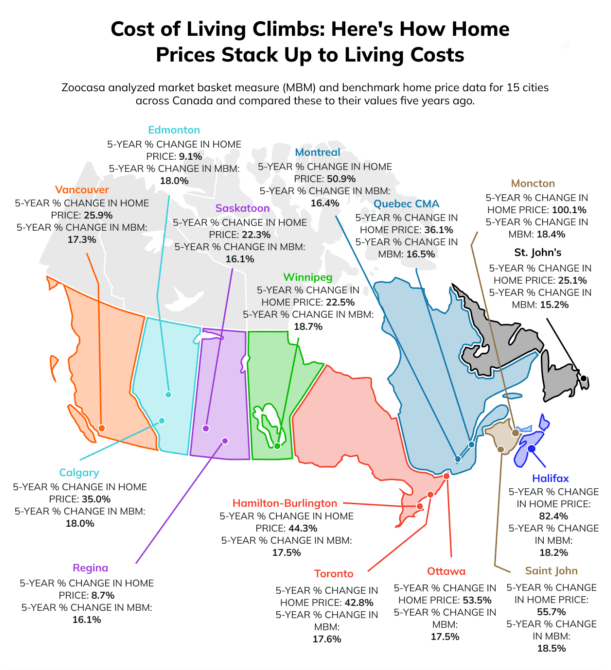

Real estate website Zoocasa.com crunched the numbers in a blog post published earlier this week in which living expenses were compared against the benchmark home price in 15 Canadian cities over the two five-year periods.

In Toronto, the report showed that the Market Basket Measure (MBM), which represents the costs of goods and services like food, clothing, and shelter for an average family of two adults and two children, was at $55,262 in 2022.

The MBM, which Statistics Canada cites as the official measure of poverty in a given city, was $46,975 in 2017, meaning that the cost of living has jumped 17.6 per cent in those five years.

While that may seem like a lot, Toronto’s benchmark home price has risen by 42.8 per cent since 2019.

According to Zoocasa, which sourced its real estate data from the Canadian Real Estate Association (CREA), the benchmark home price in Toronto five years ago was $746,500. Now, in 2024, that number is $1,065,800.

“With home prices rising at a rate much faster than the cost of living, many Canadians are finding it increasingly difficult to find affordable housing options,” Carrie Lysenko, CEO of Zoocasa, said in the report.

The report notes that although Toronto and Vancouver had the third and second-highest MBMs in 2022 (Calgary was highest at $55,771), benchmark home prices in those cities did not increase as “significantly” as they did in smaller ones like Moncton and Halifax — where home prices have gone up 100.1 per cent and 82.4 per cent, respectively, since 2019.

The cost of living between 2017 and 2022 is compared to the benchmark home price between 2019 and 2024 across 15 Canadian cities in this study by Zoocasa.com. (Zoocasa)

The cost of living between 2017 and 2022 is compared to the benchmark home price between 2019 and 2024 across 15 Canadian cities in this study by Zoocasa.com. (Zoocasa)

Conversely, in two of the 15 cities surveyed in the study, the benchmark home price actually lagged behind the MBM.

In Regina, for example, the 5-year change in home price was 8.7 per cent while the MBM between 2017 and 2022 was 16.1 per cent. Similarly, in Edmonton, the average home price went up by 9.1 per cent while the MBM hit 18 per cent.

“Even in cities where the cost of living is on the rise, the relatively stable home prices present a unique opportunity for homebuyers to enter the market,” Lysenko said on this point.

“This underscores the importance of exploring options beyond the primary metropolitan areas or single-family detached homes for those seeking affordability in today’s market.”

View original article here Source