More than $55M has been lost to investment scams in Toronto over the last 9 months. Is ‘pig butchering’ making it worse?

It starts small – an initial investment of just a few hundred dollars.

“Then, the victim will see a small return,” says David Coffey, a detective with the Toronto Police Services’ Financial Crimes Unit. “That’s how it snowballs, and that’s how people get hooked.”

Investment scams, in which victims are convinced to invest their money by fraudulent promises of high returns, have been around for decades but only last year did police start tracking the total dollar value lost to the scheme in Toronto.

Since May 2023, more than $57 million has been reported stolen in investment scams from Toronto residents, Coffey told CTV News. Of that loss, about 20 per cent was reported this year.

According to Coffey, however, the number likely vastly underrepresents the true extent of the problem; “It’s estimated only five to 10 per cent of investment frauds are reported,” he explained.

The figure comes amid the rise of a new variation on the classic investment scheme, known as ‘pig butchering.’ It’s a hybrid of sorts between a romance and investment scam, in which the victim is lured into putting their money into cryptocurrency.

David Rotfleisch, a tax lawyer in Toronto, said he’s met with more than a dozen prospective clients since the start of the year who had fallen victim to the new iteration.

“It really upsets me every time I get one of these in,” Rotfleisch said. “And this week, there were three of them.

Despite its name, there is no swine involved. Instead ‘pig butchering’ refers to the time spent building a relationship with the victim – or fattening them up– before eventually convincing them to invest. This stage of the scam can go on for weeks to months.

“It’s an apt description, but it’s a term coined by the fraudsters – it’s a ‘we’re fattening up the pigs’ kind of thing. It’s offensive to the victims, but that’s what they’re calling it,” Coffey said.

This latest iteration of scam has proven a problem in Toronto and across the globe. In fact, researchers in Texas estimated in February that more than USD 75 billion has been lost to pig butchering worldwide.

The ‘pig butchering’ scam: What is it?

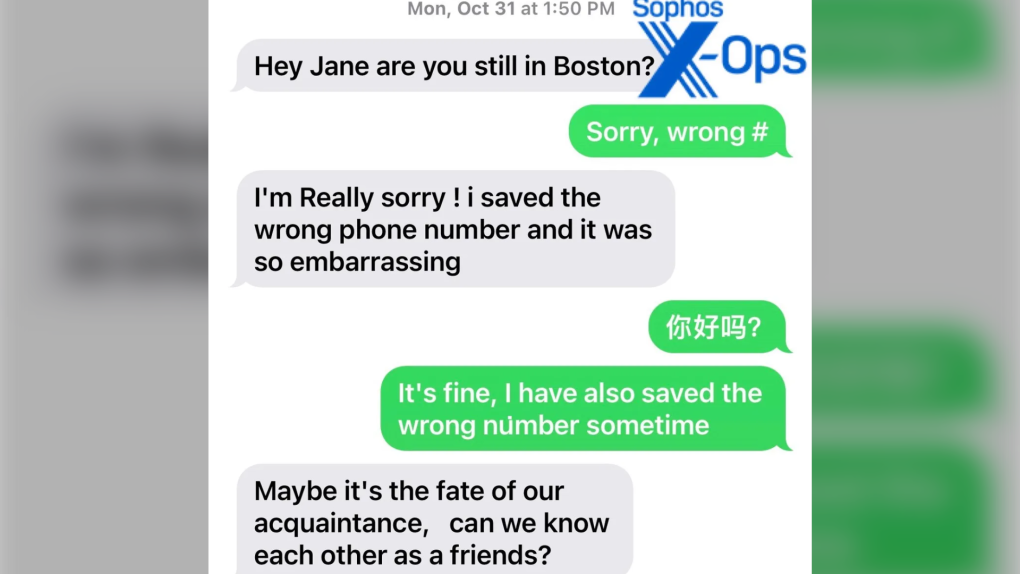

‘Pig butchering’ is thought to be behind an influx of seemingly random messages being received by people all over the world from unknown numbers.

The sender of the message will ask a mundane question, sometimes addressing the recipient by a name that is not theirs. When the recipient responds, it sometimes sparks further conversation, police say.

“The bottom line is that a relationship ends up developing,” Coffey said.

An example of an initial exchange attempting to lure the recipient into the ‘pig butchering’ scam. (Sophos)

An example of an initial exchange attempting to lure the recipient into the ‘pig butchering’ scam. (Sophos)

Once trust has been established, an opportunity to invest is put forth to the victim.

“First, it’s $250 or $500, but then they’ll say, ‘Well, now you’ve just earned $1,000, give us another $5,000,’ and so on,” the detective explained.

At this point, often the victim remains unaware of the truth of the situation – some, even excited to earn more.

But the money isn’t being invested, Coffey said.

“Over time people are captivated by the illusion of profits that don’t exist. They’re not being invested – they’re going straight into the pockets of these criminal organizations.”

Victims tend to realize they’re in trouble only when they try to take their money out – correspondence drops off, excuses start being thrown out, and eventually, the facade drops.

Eventually, fraudsters will send the proceeds to centralized crypto exchanges and cash them out for traditional money. Last November, the founder of Binance, one of the most popular exchanges, pleaded guilty to criminal anti-money-laundering and sanctions charges and was ordered to pay USD 4.3 billion.

Victims of these kinds of scams are most often not wealthy individuals looking to grow profits, as some might expect, Coffey explained – they’re people without money, desperate for income, and willing to use what little they have to acquire more.

The people sending the messages, on the other hand, are not necessarily the masterminds behind the crime – often, they are victims themselves, of human trafficking, the study out of Austin revealed. According to UN data, more than 200,000 people have been lured to compounds in countries such as Cambodia and Myanmar with offers of high-paying jobs, only to be trapped and forced to initiate a scam overseas.

That’s not the only method, though – another report released in February, by cybersecurity firm Sophos, found that cybercriminals were selling ready-to-go ‘pig butchering’ scam kits, which include a web page that can connect to a victim’s crypto wallets and often, an installed chat feature which can be used to provide “technical support” to their victim.

Can police tackle investment scams?

As ‘pig butchering’ takes place online, often by perpetrators overseas, tackling it can prove difficult for local police departments. Even the Toronto Police Service, the biggest in the country, is “hamstrung” in responding to such scams, Coffey said.

“Once the money has been sent off – I’m not going to say it’s impossible – but it’s very unlikely they will ever see it again,” Coffey said. “It’s just a really, really, really sad and harsh reality.”

If a criminal investigation is launched, while it may be the complainant’s intention to receive their money back, the task of police is not to recoup on your loss, but to lay a charge – a process made exponentially more challenging if the fraudster is operating internationally.

It’s a sentiment echoed by Tom Warren, private investigator of cybercrime and founder of Net-Patrol International. In his time investigating ‘pig butchering,’ Warren has seen up to $12 million lost in just one case.

“Absolutely not – not the small departments,” he replied when asked if police departments are equipped to handle the onslaught of fraud facing Canadians. “Half the time, even with very simple forensic jobs, they have to bump it up to their provincial or federal police department for assistance.”

“It’s just not possible – even the large departments, like Toronto, struggle with it in part because they don’t know enough about this type of technology to dig into it,” he continued.

Without more investment and research, Canadian officials can only continue to react rather than prevent these kinds of scams, according to Warren.

He points to Singapore and its CyberCrime Command Commission as an example of strict online enforcement across borders.

“We’re at a point now, unfortunately, where the federal government has to get involved. There has to be a commission of sorts focusing solely on cyber issues, whether it be crypto, whether it be breaches, whether it be child pornography or anything else in between,” Warren said. “Because the current model, it just doesn’t work anymore.”

More than $55 million dollars has been lost to investment scams in Toronto in less than a year, according to police. A man uses a computer keyboard on Sunday, Oct. 9, 2023 photo illustration. THE CANADIAN PRESS/Graeme Roy

More than $55 million dollars has been lost to investment scams in Toronto in less than a year, according to police. A man uses a computer keyboard on Sunday, Oct. 9, 2023 photo illustration. THE CANADIAN PRESS/Graeme Roy

How to avoid ‘pig butchering’

Due to the personalized nature of ‘pig butchering’ and many other investment, romance, or personal scams, it can be hard to recognize upfront.

If you receive a text message from an unknown number, immediately assume it to be a scammer, police advised. Do not click on unknown links and be wary of anyone contacting you claiming to be a government official or bank employee.

They suggest taking a breath, and not engaging with the message immediately. First, spend some time thinking critically about its origin.

“Do your due diligence, right? And spend a little money doing it – consult with reputable people who work in investment or cryptocurrency,” Warren said. “They’re not too expensive to talk to.”

Potential investors need to make sure the companies they are going into business with are authentic and trustworthy – the “easier” the investment is to make, the more wary you should be, says Coffey.

“You should not be looking for quick investment opportunities online,” he said. “If you do, be aware that you’re making yourself ultimately vulnerable and susceptible to this type of fraud.”

If you’ve already invested money, “you may be in trouble,” Warren added. “Again, you’re probably not getting your money back, but really, you need to act fast.”

In 2023, the Canadian Anti-Fraud Centre says it was made aware of more than 4,010 instances of investment scams in which over$309 million was reported stolen. More than half of that amount is related to cryptocurreny, it said.

With files from CTV News’ Natasha O’Neill, and BNN Bloomberg’s Zeke Faux and Sana Pashankar.

View original article here Source